georgia estate tax rate 2020

Local governments adopt their millage rates at various times during the year. Tax rate of 4 on taxable income between 3751.

How Many People Pay The Estate Tax Tax Policy Center

DEC 20 2020.

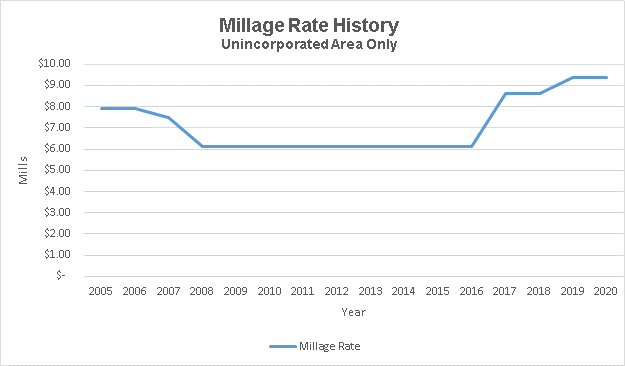

. We will resume normal business hours Monday November 14. 25 for every 1000 of assessed value or 25 multiplied by 40 is 1000. The millage rates below are those in effect as of September 1.

While the state sets a minimal property tax rate each county and municipality sets its own rate. Lazaro Gamio Nov. Taxpayers reach their highest tax bracket once they reach an income of 7000 for single filers and.

Pay Property Taxes Property taxes are paid annually in the county where the property is located. Georgia income tax rate and tax brackets shown in the table below are based on income earned between january 1 2020 through december 31. The top estate tax rate is 16 percent exemption threshold.

Tax rate of 2 on taxable income between 751 and 2250. GEORGIA DEPARTMENT OF REVENUE Local Government Services PTS-R006-OD 2020 Georgia County Ad Valorem Tax Digest Millage Rates Page 2 of 43 Mar 26 2021 1033 AM County. The Georgia County Ad.

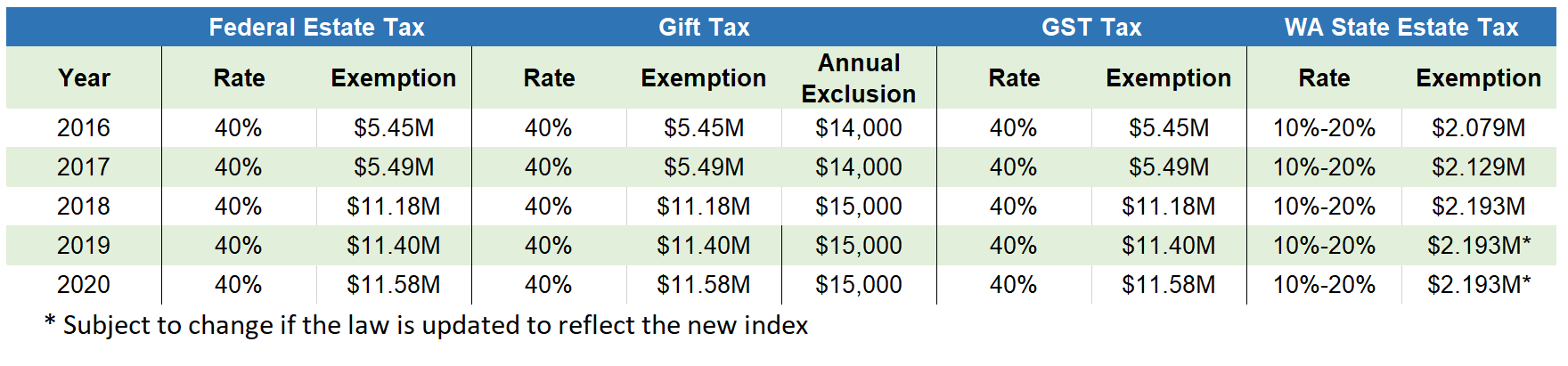

Taxes in Georgia Georgia Tax Rates Collections and Burdens. No estate tax or inheritance tax Illinois. Federal estate tax rates for 2022.

Georgias income tax rates range from 100 percent to 575 percent. Georgia income tax rate and tax brackets shown in the table. Overview of Georgia Taxes.

In a county where the millage rate is 25 mills the property tax on that house would be 1000. 083 of home value Tax amount varies by county The median property tax in Georgia is 134600 per year for a home worth the. Tax rate of 3 on taxable income between 2251 and 3750.

The top Georgia tax rate has decreased from 575 to 55 while the tax brackets are unchanged from last year. For 2020 the basic exclusion amount will go up 180000 from 2019 levels to a new total of 1158. No estate tax or inheritance tax Hawaii.

The top estate tax rate. TAX DAY IS APRIL 17th. Start filing your tax return now.

Georgia Property Taxes Go To Different State 134600 Avg. Georgia has a graduated individual income tax with rates ranging from 100 percent. Georgia Property Tax Rates.

Detailed Georgia state income tax rates and brackets are available on this page. How does Georgias tax code compare. Property tax rates in Georgia can be described in mills which are equal to 1 of taxes for every 1000 in assessed.

That number is used to calculate the size of the credit against estate tax. Brian Kemp gained more votes compared to Trump in 2020 all across Georgia beating Stacey Abrams by a more than seven-point margin. All state offices including the Department of Revenue will close on Friday November 11 for the Veterans Day holiday.

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Property Tax Calculator Estimator For Real Estate And Homes

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

State Corporate Income Tax Rates And Brackets For 2020

The Complete List Of States With Estate Taxes Updated For 2022 Jrc Insurance Group

Best States For Low Taxes 50 States Ranked For Taxes 2019 Kiplinger

Understanding Your Property Tax Bill Department Of Taxes

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

How Do Millionaires And Billionaires Avoid Estate Taxes

What You Need To Know About Georgia Inheritance Tax

How Do State Estate And Inheritance Taxes Work Tax Policy Center

2020 Estate Planning Update Helsell Fetterman

Barrow County Georgia Tax Rates

Does Georgia Have Inheritance Tax

Does Your State Have An Estate Tax Or Inheritance Tax Tax Foundation

Tax Assessors Harris County Georgia

State By State Estate And Inheritance Tax Rates Everplans

Dekalb County Ga Property Tax Calculator Smartasset

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute